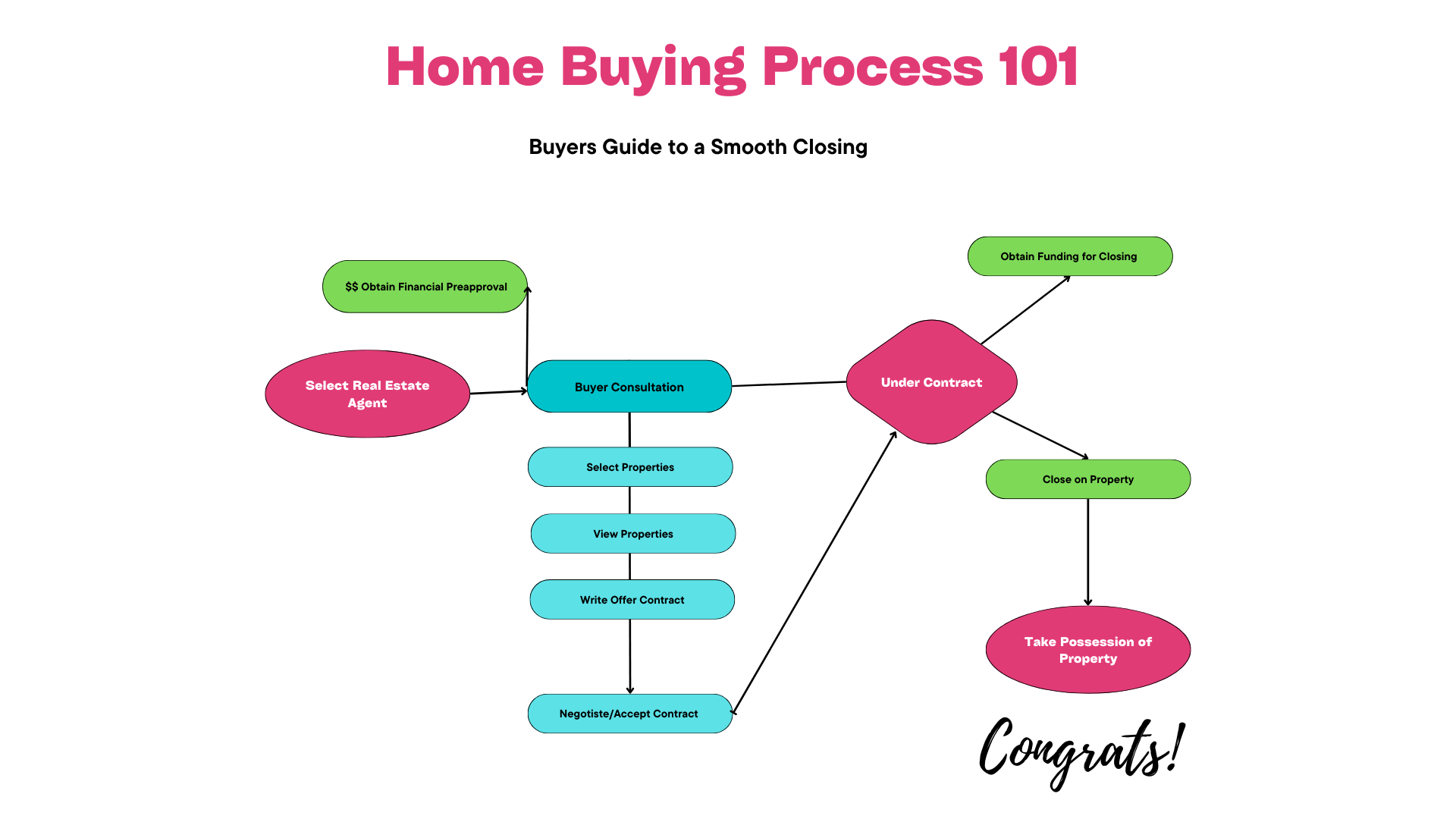

The homebuying process can seem daunting to the first time buyer and frustrating at times to the experienced buyer as well. Depending on the stages of the home buying diagram the process can look slightly different. Reviewing the below buyer’s diagram starts at the real estate broker but experience shows the buyer may start in 1 of 3 places: the real estate agent, online home searching on their own or asking a lender for preapproval.

- Select a Real Estate Agent: Hiring a real estate agent should be more complex than selecting a person from an advertising sidebar. The most important thing is not so much the years in the business, but the experience and background that the agent brings to the buyers. It is imperative that the buyer meet the prospective agent like an interview process before hiring. Things like personalities, working styles, and/or schedules don’t always come into align with the buyer’s. The relationship is optimal if there is an affinity and adequate communication.

- Analyze Your Needs in a Buyer Consultation: Learning and understanding the buyer’s priorities is highly critical to successful purchase. Knowing areas, floor plans, school districts, and commuting are just some of things to discuss.The Buyer Consultation and Buyers Representation Agreement is where the buyer solidifies the relationship from prospect to client and the agent is now hired to represent your interests. This is a crucial step to buy confidently that your agent has a fiduciary duty to represent you, not the seller.

- Obtain Financial Preapproval: This step should not be done with a website’s financing calculator. Why? Because those tools are not designed to get the whole financial story like credit, income, taxes, child support, outstanding debt, foreclosures, short sales, medical bills and so on. It is important that your real estate agent works closely with a trusted bank or mortgage brokers in order to explain the process which at times can be difficult and be able to troubleshoot any issues along the way.

- Select Properties: Selecting properties can be overwhelming sometimes because it depends on the buyer’s priorities and knowing what type of loan will bw qualified. Real estate brokers search the MLS (Multiple Listing Service) for possible homes and buyers can search through online home search to review images, property details, prices, and price reductions.

- View Properties: It is GO TIME! The realtor schedules appointments to view the selected homes with the buyer. The process requires confirmaiton with both the listing agent and/or the homewoner. Also, there can be restrictions on showings, ex. if there a tenant in a home, that can prevent certain times for showings but typically sellers are accommodating.

- Write an Offer: You found THE Home you love! It is time to put your best offer on the table. This is more commonly known as a Purchase and Sale Contract. It contains: buyer’s and seller’s full names, property address, purchase price, earnest money, addenda, closing and offer expiration dates. That offer is then presented to the listing agent, this is the agent that has the home for sale and represents the seller. The listing agent then presents the offer to the homeowner. The Buyer waits to hear back.

- Negotiate Contingencies: An offer is more attractive to the seller when contingencies are removed. Contingencies are contractual buyer protections put in the contract that protect the buyer’s rights and earnest money. Some common contingencies are the home inspection, financing, appraisal, septic, title, and feasibility studies.

- Obtain Funds for Closing: Once the offer is accepted the buyer needs to focus on obtaining the funds for closing. This where the appraisal, underwriting, final credit checks, employment verification, any financial explanation letters required all happens. During this time the the buyer will sign lender required disclosures as requested.

- Close on the Property: The Buyer may hire an attorney or title company to prepare the closing. They usually hold the escrow deposit and are commonly called the escrow company. They will close the transaction and will receive the loan documents, title documents. Escrow puts together a HUD1 Settlement Statement for the lender’s and agent’s review, arranges the signings, manages the wire transfers, disburses funds to all parties, and sends the documents for recording after closing to the County Clerk. When the documents are recorded, they are issued official recording numbers and the buyer officially NOW owns the property.

- Take Possession of the Property: Buyers receive their house keys at closing upon sellers receipt of the closing funds and documents sent to recording. NOW you are an official homeowner!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link